The browser you are using is not supported. Please consider using a modern browser.

The Ultimate Guide to the Average Cost of Living in Pennsylvania

Table of Contents

Living in Pennsylvania has its perks — from the historic city life in Philadelphia to the charming, laid-back feel of Lancaster and Erie. But before you pack your bags and visit or settle down in the Keystone State, you will want to know: How much does living in PA cost?

This guide breaks down the numbers on everything from housing and groceries to electricity rates and even healthcare. We’ll also examine how Pennsylvania’s cost of living stacks up against other states. Whether you’re a homeowner, renter, or business owner, we will show you how you can live in the PA as affordably as possible.

Comparing Pennsylvania to the Rest of the U.S.

PA ranks 27th in the overall cost of living compared to the rest of the United States. However, it’s important to note that costs can vary significantly within the state. Urban areas like Philadelphia and Pittsburgh have higher living costs than rural areas or smaller towns.

What’s the Average Salary in Pennsylvania?

When considering the cost of living, one significant factor is how much you can expect to earn. The average salary in Pennsylvania sits around $62,000 per year, which is right in line with the national average. Your specific income will depend largely on where you live and the industry you work in.

For example, if you’re in Philadelphia, the state’s largest city, salaries tend to be higher, with an average of $68,000 annually. The city is home to major healthcare, education, and finance companies. On the other hand, Pittsburgh offers an average salary of $63,000, with recent growth in the tech and healthcare sectors. In smaller towns like Erie or Harrisburg, you can expect salaries around $50,000 to $55,000, though living expenses in these areas are often lower.

No matter where you settle, Pennsylvania provides a variety of opportunities for the nearly 13 million people who call it home.

How Much Can You Save Pennsylvania?

Shop electricity rates from leading providers and make the switch today.

Housing Costs in Pennsylvania: Buying vs. Renting

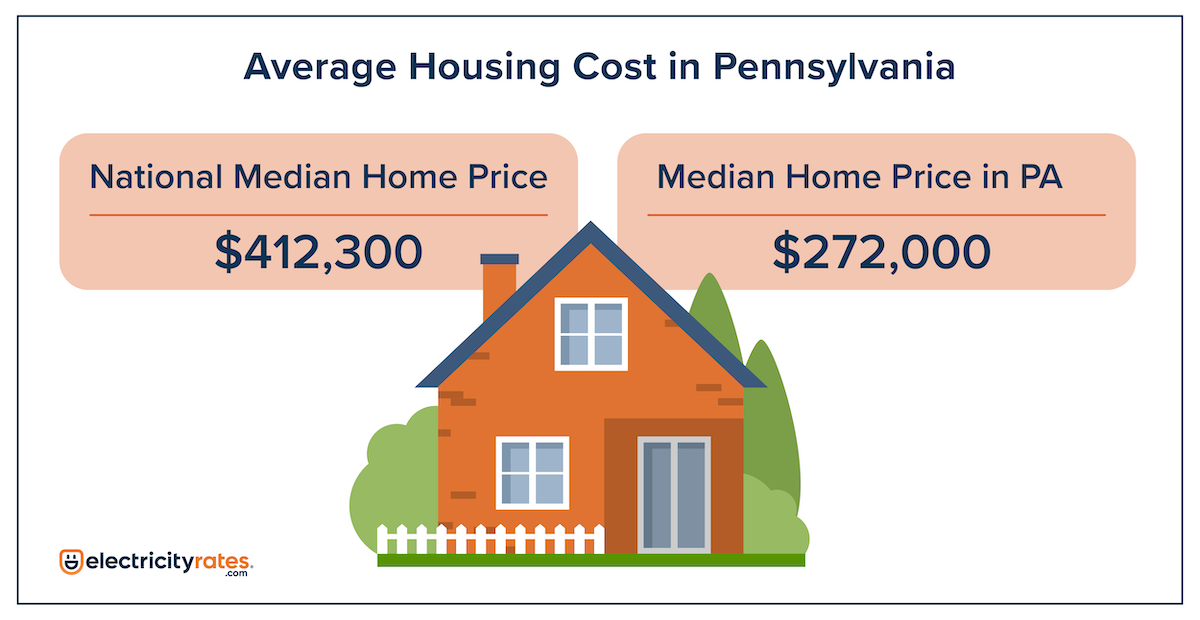

When it comes to housing, Pennsylvania is more affordable than many of its neighboring East Coast states, especially New York and New Jersey. Whether you’re planning to buy a home or rent an apartment, Pennsylvania has options to fit most budgets.

- The average home price in Pennsylvania is $272,000, far below the national average of $412,300.

- Philadelphia tends to be more expensive, with the average home price around $275,000, though in some areas of the city, homes can go for well over $500,000.

- In Pittsburgh, homebuyers find better deals, with average home prices near $230,000.

Rent prices vary by city but average $1,696 a month statewide. In Philadelphia, you’ll pay around $1,400 to $1,700 a month for a two-bedroom apartment. In Pittsburgh, rent is more affordable, averaging $1,200 for the same setup. Smaller cities like Allentown and Lancaster are even more affordable, making them attractive to those looking for lower housing costs, especially compared to the national rent average of $1,739.

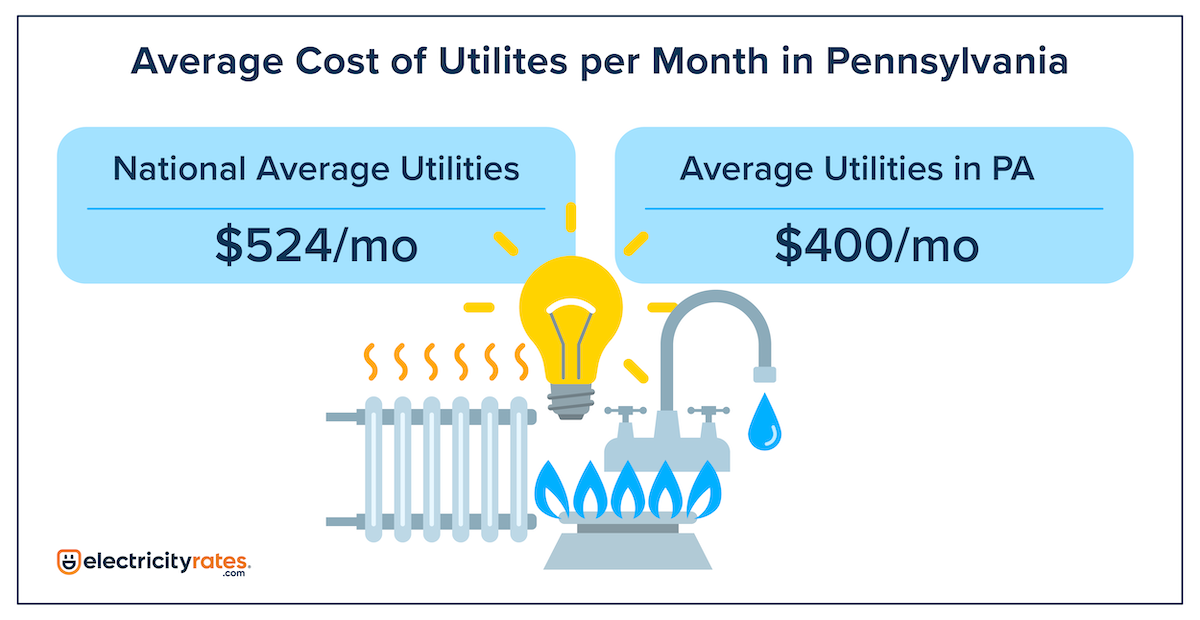

Utility Costs in Pennsylvania: What to Expect on Your Bills

The national average for utilities costs sits at $524 per month. Pennsylvania’s utility costs land slightly below the national average at $443. Across the state, residents pay between $350 and $450 monthly for essential utilities, including electricity, gas, water, and internet. However, these costs vary depending on your location and the size of your home.

Electricity costs, for example, average around $130 per month. Pennsylvania benefits from having a deregulated electricity market, meaning you can shop around for the best rates. In comparison, natural gas, which many homes use for heating, typically runs about $80 per month—though it spikes in the colder winter months. Internet and cable services range from $60 to $100 per month.

Electricity Rates in Pennsylvania vs. the Rest of the U.S.

One of the perks of living in Pennsylvania is the deregulated electricity market, which allows you to choose your electricity provider and find the best rates for your household. Also known as Energy Choice, this freedom gives you more control over your monthly bills and often results in savings compared to states where you’re stuck with a single utility company.

- Average electricity rate in Pennsylvania: $0.18 per kilowatt-hour (kWh)

- National average: $0.16 per kWh

With the 11th highest rate nationally, Pennsylvania residents pay slightly more for electricity than others. Use our comparison tools to switch to the most cost-effective electricity plan, saving money in the long run whether you live in Pittsburgh, Philly, or elsewhere.

How Much Do Groceries Cost in Pennsylvania?

Regarding groceries, Pennsylvania has experienced one of the highest grocery price hikes in the nation at 8.2% year-over-year, significantly above the national average increase of 5.3%. However, even with the recent surge, PA is well below the national average of $475 monthly per person. Keystone residents spend $278 per person on groceries and from $800 to $1,000 for a family of four. Grocery prices will vary based on where you live and your shopping habits. For instance, if you’re living in Philadelphia or Pittsburgh, you might find grocery bills on the higher end, closer to $1,100 per month.

A few everyday grocery items include:

- Milk: About $3.60 per gallon.

- Bread: Around $2.50 per loaf.

- Eggs: Approximately $3.20 per dozen.

Smaller cities like Harrisburg or Allentown offer slightly cheaper groceries, making it easier to stretch your food budget. And don’t forget—shopping at local farmers’ markets and discount grocery stores can help lower your overall grocery costs.

Transportation Costs in Pennsylvania: Gas, Public Transit, and More

Gas prices in Pennsylvania hover around $3.30 for regular and $3.80 per gallon for mid-grade. This is slightly above the national average, and car insurance averages $1,500 annually.

However, public transit offers a more affordable and convenient option for residents of cities like Philadelphia and Pittsburgh. The Philadelphia SEPTA system has monthly transit passes available for $96, while Pittsburgh’s Port Authority charges about $97 for its monthly passes.

Both cities offer reliable and widespread transit systems, making it easy to get around without a car and save money on gas, maintenance, and parking.

Healthcare Costs in Pennsylvania

Healthcare is a critical part of the cost of living, and in Pennsylvania, it’s relatively affordable compared to the rest of the U.S. The average monthly health insurance premium is around $475, though this varies depending on your plan, employer contributions, and other factors.

For those without insurance, a visit to the doctor typically costs between $100 and $150. Prescription drug prices can also vary, but with insurance, many people pay $10 to $40 per prescription. Pennsylvania also has a wide range of healthcare providers and hospitals, so residents have plenty of choices regarding medical care.

Healthcare costs in Pennsylvania are on par with the national average and, in some cases, even lower than what you’d find in neighboring states like New York or New Jersey.

Taxes in Pennsylvania: Income, Property, and Sales Tax

Let’s talk taxes! Pennsylvania offers a relatively low income tax rate of 3.07%. It’s one of the lowest in the country. This flat tax rate applies to all residents, regardless of income level, which makes it a great perk for many who live here. In addition to the income tax, there are a few other taxes you’ll need to consider.

- Property tax: Pennsylvania’s property tax averages around 1.46%, although this can vary depending on the county.

- Sales tax: The state has a 6% sales tax, but in Philadelphia, an additional 2% local tax brings the total to 8%. Other cities, like Pittsburgh, don’t have that extra local tax, keeping sales taxes lower.

Pennsylvania ranks 25th for overall tax burden, with a combined tax rate of about 8.9% of personal income from property, income, and sales taxes. This places Pennsylvania below high-burden states like New York (12.28%) and New Jersey (9.88%) but above lower-burden states like Florida (6.82%) and Wyoming (3.81%).

Conclusion: Is Pennsylvania Affordable?

When you add everything up, Pennsylvania offers an attractive balance between affordability and quality of life. Whether looking at competitive electricity rates, affordable housing options, or reasonable costs for groceries and healthcare, Pennsylvania is an excellent choice for anyone wanting to live comfortably without breaking the bank.

Cost of Living in Pennsylvania FAQ's

-

The cost of living in Pennsylvania depends on where you live, but generally, it’s lower than in many nearby states. Housing, utilities, and taxes are all fairly reasonable.

-

Pennsylvania’s average electricity rate of $0.14 per kWh is below the national average, and thanks to the state’s deregulated market, you can shop around for better rates.

-

Pittsburgh is the more affordable option, with lower housing costs and utility bills. Philadelphia is pricier but still more affordable than other large East Coast cities.

-

Groceries cost between $800 and $1,000 per month for a family of four, though you can save by shopping at farmers’ markets or discount stores.

-

In Philadelphia, rent averages $1,400 for a two-bedroom, while in Pittsburgh, it’s about $1,200.