The browser you are using is not supported. Please consider using a modern browser.

PJM Prices Skyrocket Again for the 2025–2026 Delivery Year

AI data centers spike PJM capacity prices to a record high for 2025-26.

Key Takeaways

- PJM’s 2025–26 capacity auction cleared at a record $329.17/MW-day, about a 22% jump, signaling tighter grid conditions and higher future costs.

- Exploding power demand from AI and data centers is a major driver of rising PJM capacity prices, while new generation and grid upgrades lag behind.

- Policy and market decisions in PJM, including how to handle data center costs and keep older coal and gas plants online, will shape reliability and customer bills.

- Homeowners and businesses in deregulated PJM areas can protect themselves by understanding their kWh usage, comparing plans, and switching electricity providers to lock in better rates.

Table of Contents

67 million Americans from Illinois to New Jersey are about to be shocked by yet another power grid plot twist.

PJM Interconnection’s latest capacity auction hit the price ceiling of $329.17 per MW-day, up 22% from $269.92 in the last auction. That means the “management cost” your power company pays to keep the lights on just got a lot more expensive.

The big question now on every energy consumer’s mind: Will PJM keep power affordable for regular people—or bend over backward for AI data centers that consume more power than entire cities?

Let’s break it down in plain English and talk about what you can actually do to protect your electric bill from spiking this coming year.

PJM 101: The giant grid “group chat” you never joined

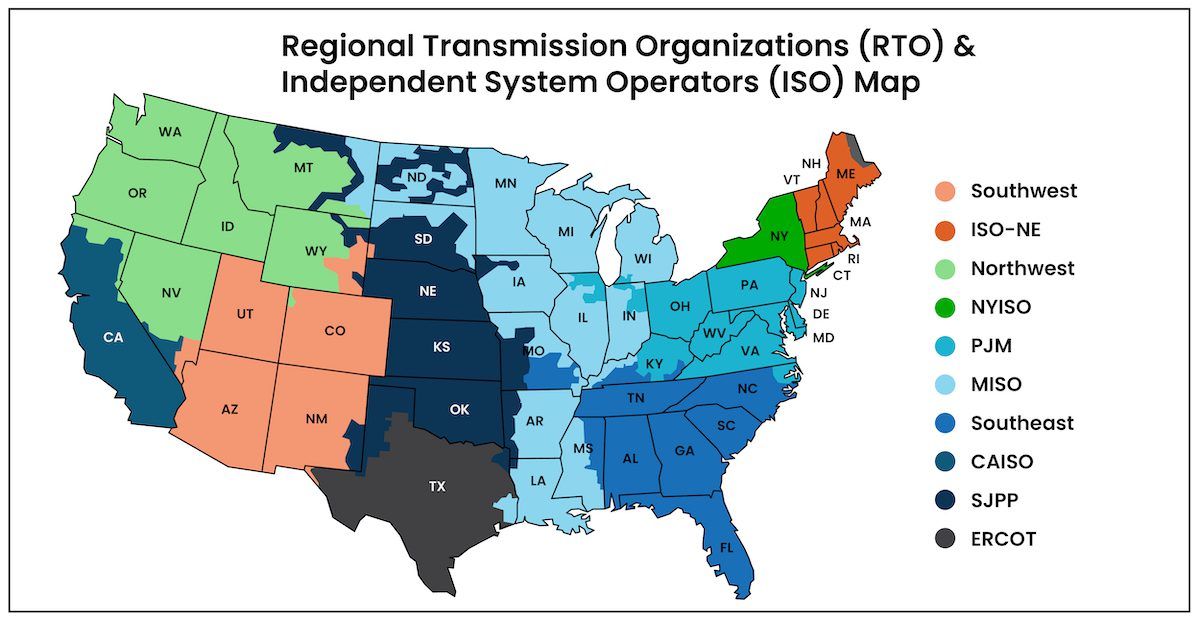

PJM Interconnection, founded in 1927, is the U.S.’s largest regional transmission organization (RTO) and operates the country’s largest competitive wholesale electricity market. Initially serving Pennsylvania, New Jersey, and Maryland, PJM’s reach has significantly expanded.

It manages the high-voltage grid and wholesale power markets for all or parts of 13 states plus D.C., serving about 65–67 million people from Illinois to New Jersey.

Think of PJM as the air traffic controller for electricity, with the mission of maintaining grid and energy market stability. It doesn’t build the grid or generate power, but it:

- Coordinates which power plants run and when

- Manages energy markets (power you use right now)

- Runs a capacity market that pays power suppliers for their commitment to be available to meet future demand, rather than just for the energy they produce

On the PJM Interconnection map, the territory looks like a big electric spiderweb over:

Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia, West Virginia, and Washington, D.C.

If you live or work in the PJM interconnection area, this PJM news directly affects you.

Break Up With Your Electricity Provider

Shop electricity rates from leading providers and make the switch today.

PJM capacity auction results: why the new rates are driving up energy prices

Each year, PJM runs a Base Residual Auction (BRA) — its big capacity auction. Utilities and suppliers bid for the right to get paid by PJM just to be available three years in the future to meet projected demand. An energy capacity market is essentially an insurance system where power suppliers are paid to guarantee they will have power available to meet future peak demand, regardless of whether that power is actually produced.

In the most recent auction for the 2026–2027 delivery year:

- The capacity price hit $329.17 per MW-day across all zones

- That’s up about 22% from $269.92 per MW-day in the previous 2025–2026 auction

- PJM bought about 134,311 MW of capacity (enough to cover peak demand for over 67 million people)

PJM expects these record-high PJM capacity prices to raise some customer bills by about 1.5% to 5%, depending on your specific state and utility.

While this won’t double your bill overnight, the hike is being announced right after a nine-fold price increase last year. That’s what has consumer advocates, governors, and legislators on high alert.

Why PJM capacity prices keep jumping: it’s not just “bad luck”

PJM and its independent market monitor have made it clear: the grid is tight because demand is rising fast and supply is not keeping up.

Here’s what’s driving the squeeze:

1. AI and data centers are power-hungry monsters

The roughly 2,700 data centers in the U.S. consumed over 4% of all electricity in 2022, and that figure is projected to more than double to 9% by 2030. This figure is expected to rise as more companies transition to AI models and cloud-based services, and as demand for data storage increases.

PJM has said it expects around 32 GW of new demand by 2030. AI and data centers are responsible for nearly all of that growth. NRDC and utility forecasts inside PJM warn that data center demand could need more than 50 GW of peak capacity by 2030—enough to currently power every home in New Jersey, Pennsylvania, Ohio, Virginia, and Maryland combined.

2. Supply has not caught up

Even with the recent auction, PJM added only about 2,669 MW of new and upgraded generation, roughly half of what’s needed to keep up with projected demand.

At the same time, older plants have retired or tried to quit. Some have been kept around on special “keep the lights on” deals (see below for examples).

3. High-capacity prices are supposed to “fix it.”

In theory, these high PJM capacity auction prices are a signal for developers that the market demand is present to build new plants. In the real world, things are messier:

- New projects face interconnection delays and supply chain problems.

- Local opposition and financing issues slow down construction.

- Clean energy projects are stuck in line in PJM’s interconnection queue.

So we end up with record-high PJM capacity prices, but not enough new supply, at least not soon enough to calm the market.

The data center drama: will PJM protect ratepayers or pamper AI?

New U.S. data center announcements nearly tripled in the first half of 2024, requiring 24 gigawatts (GW) of new capacity. This surge is mainly fueled by AI advancements, industry digitization, and increased cloud service reliance.

Because of the data center surge, PJM launched a “Critical Issue Fast Path” (CIFP) for Large Load Additions (LLA)—an emergency fast-track process to determine how to connect large new loads, such as data centers, without breaking the grid.

PJM’s market monitor told the CIFP-LLA group that today’s tight capacity market is “almost entirely the result of large data center load additions.”

Meanwhile:

- The Natural Resources Defense Council (NRDC) warns that if the costs of serving all these data centers are spread across everyone’s bills, PJM families could pay about $163 billion more, or about $70 a month extra for a typical household over time.

- A bipartisan group of state legislators is pushing PJM to adopt ratepayer protections to prevent regular customers from becoming the “unpaid sponsors” of Big Tech’s AI build-out.

- And in November 2025, PJM stakeholders voted down all major proposals that would have forced data centers to carry more of their own costs, leaving key decisions to PJM’s Board.

So the tension is pulsating: Will PJM keep its promise of reliable, affordable power for 67 million people—or tilt the rules toward fast-tracking AI and data centers?

How the Federal Government fits coal plants into the picture

High capacity prices plus AI-driven demand have turned older fossil plants into “reluctant heroes” in the reliability story.

Recent auctions show coal still makes up about 22% of cleared capacity, with gas at 45% and nuclear at 21%, while wind and solar remain a small slice.

Here’s what’s happening on the policy side:

- The current U.S. administration has been urging utilities to delay closing coal-fired plants so there’s enough “firm” power to meet AI-driven demand, with officials warning the country may need an extra 100 GW of firm capacity in just a few years.

- The Energy Department recently allowed a large oil-fired unit in Maryland to run beyond its normal environmental limits through 2025 at PJM’s request, and regulators have already approved keeping that unit online until 2029 for reliability.

- In Maryland, a “reliability must run” agreement has kept coal plants online that were slated for retirement, adding billions in costs to capacity results.

In other words, high PJM capacity prices and AI demand are being used as justification to keep coal and other fossil units running longer than planned.

Critics argue this locks customers into expensive, polluting power instead of speeding up the build-out of cleaner, cheaper alternatives. Supporters say it’s the price of keeping the lights on while AI and data centers explode across the PJM map.

What this PJM capacity auction news means for your electric bill

No matter what the politicians and energy buyers decide, there are specific steps to take back control of your electricity bill. First, you must understand where PJM capacity costs fit in your bill.

Here is how to read your electric bill:

Capacity costs are baked into the supply part of your rate—what your provider pays, so there’s enough power on the grid during peak times. When PJM capacity prices jump, that supply cost can creep up in future rates.

For many PJM customers, this auction could add around 1.5%–5% to monthly electric bills once the costs flow through.

While a single increase might seem small, the combined effect of these factors can lead to significant cost accumulation over the next few years, especially when you factor in regular energy price volatility, further needed grid upgrades, and exponential data center growth.

PJM families could pay about $163 billion more total, or around $70 a month extra for a typical household over time.

Your best move now: treat this like a shopping problem, not a fate

So what does all this PJM news actually mean for you as a homeowner, renter, or business owner? At a high level, PJM’s latest capacity auction sent a loud signal that the grid is under pressure. Demand from AI and data centers is growing fast, new supply is not keeping pace, and the market responded with the highest PJM capacity price allowed by regulators.

The good news? If you live in a deregulated part of the PJM management area, you benefit from Energy choice. This means you’re not stuck with whatever rate your default utility company gives you.

You can shop for a better plan and lock in a rate that works for you:

1. Enter your ZIP code on ElectricityRates.com

2. Compare the top electricity providers in your area (look at rate, term length, fees, renewable options)

3. Simply switch online – your new provider handles the paperwork, and your power still comes over the same PJM lines and poles

No one comes to your house. No one digs up your yard. It’s more like changing your cell phone plan than changing your house wiring. Compare your best local providers now to save on your energy bill!