The browser you are using is not supported. Please consider using a modern browser.

What is the Cost of Living in Ohio?

Table of Contents

Ohio, located in the heart of the Midwest, is often celebrated for its vibrant cities, charming small towns, and diverse cultural heritage. However, one of the state’s most significant appeals is its relatively low cost of living, especially when compared to other parts of the United States.

Understanding the basic costs associated with living in the Buckeye State is essential for those considering relocating to or within Ohio. Below, we’ll explore the average costs associated with housing, utilities, groceries, and other necessities in Ohio, providing a comprehensive picture of what it’s like to live here financially.

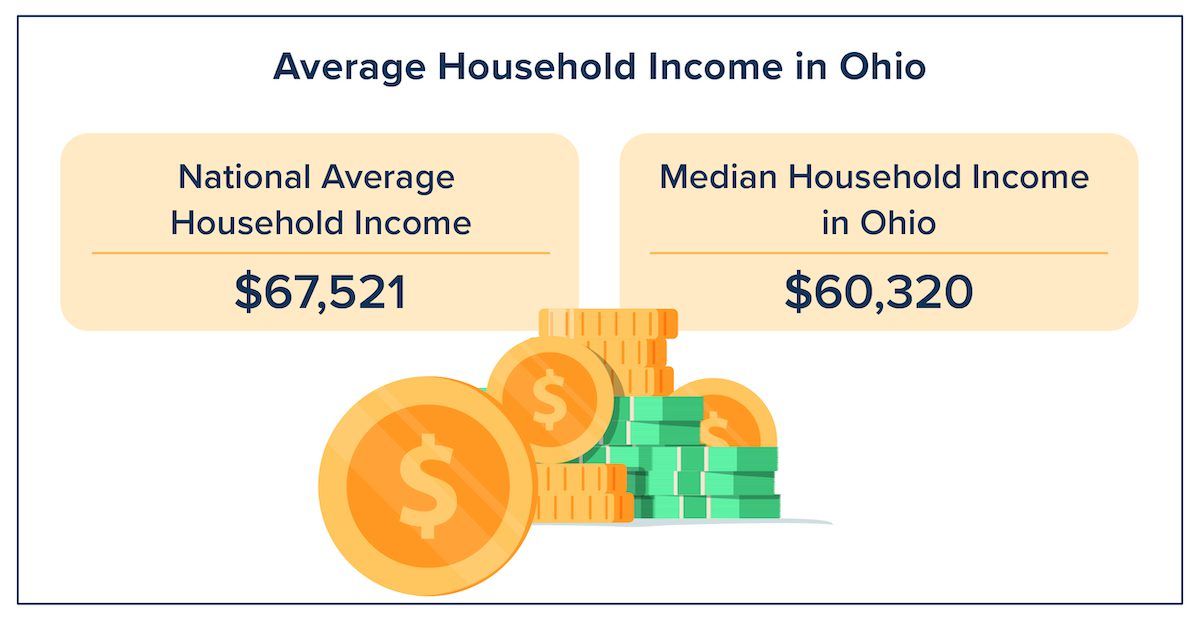

Average Salary in Ohio

Before diving into the specifics of living costs, it’s important to consider the average income in Ohio.

As of 2023, the median household income in Ohio is approximately $60,320 per year, slightly below the national household median of $67,521. This income level is generally sufficient to cover the cost of living in most parts of the state, but, as with any location, how far your income stretches depends on where you live and your lifestyle choices.

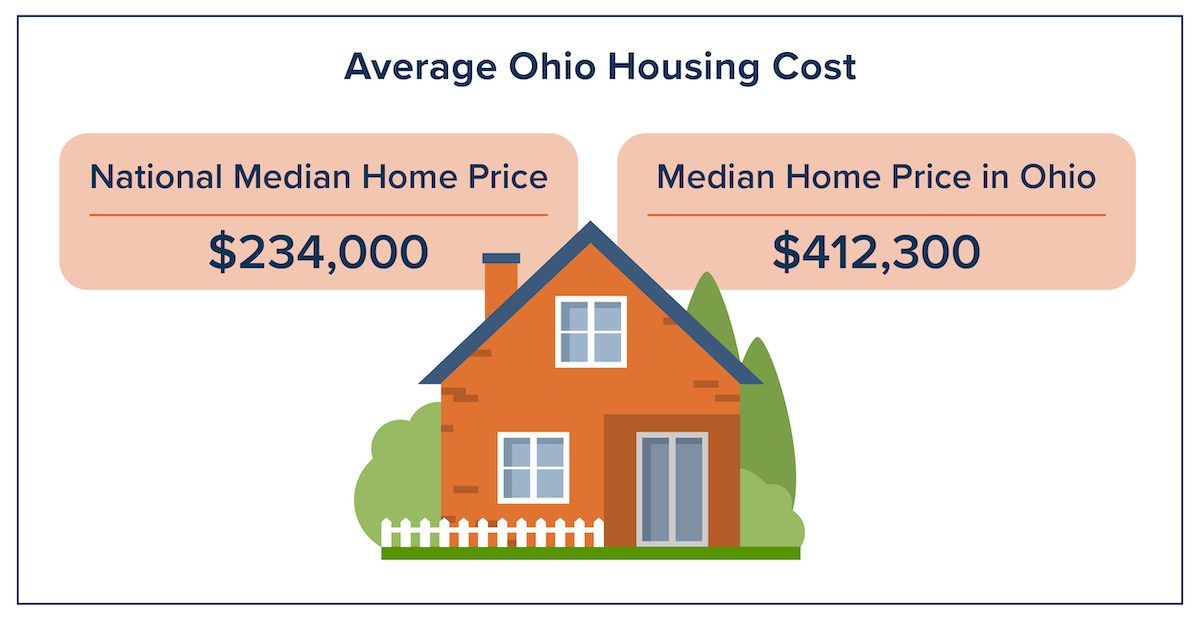

Housing Costs: Renting and Buying

One of the most significant expenses for any household is housing, and Ohio offers some of the most affordable options in the country. The median home price in Ohio is about $234,000, significantly lower than the national median home price of approximately $412,300. This makes Ohio an attractive destination for homebuyers looking for more space or a better neighborhood without breaking the bank.

For those who prefer to rent, the average monthly rent for an apartment in Ohio is around $1,000. This figure can vary significantly depending on the city or town. For example, in Columbus, the state capital and largest city, the average rent is slightly higher, around $1,250 per month. In contrast, smaller towns and rural areas may offer monthly rental prices below $900. Townhouses and single-family homes typically have higher rental costs but offer more space and amenities, making them a popular choice for families.

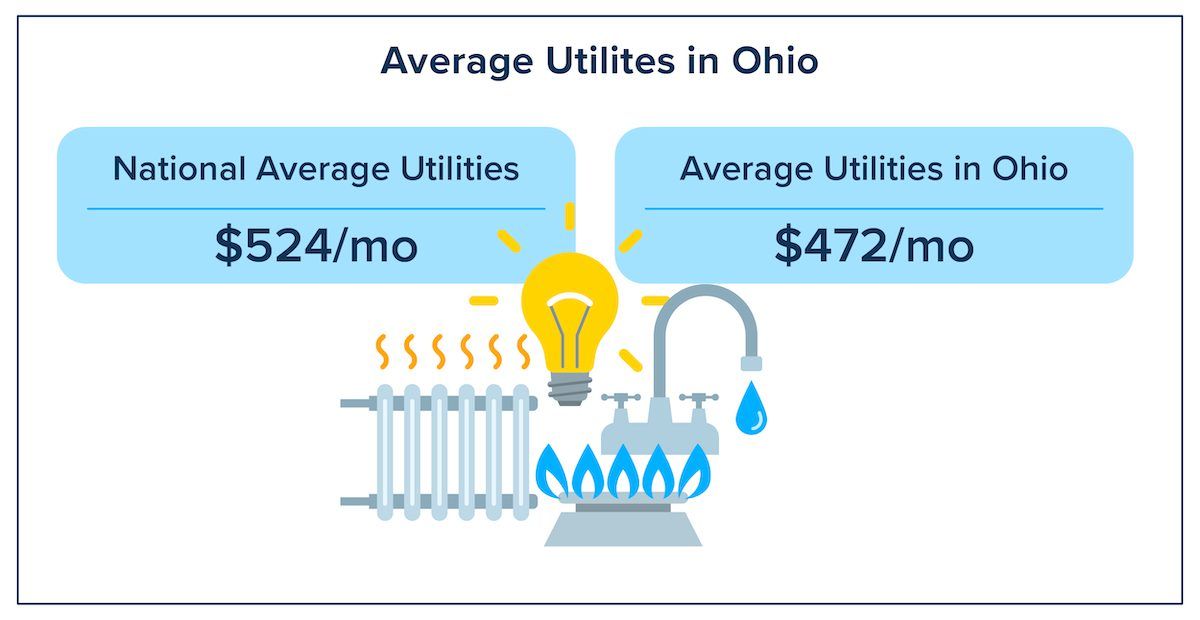

Utilities and Essential Services

Utilities are another crucial component of the cost of living, and Ohio residents generally enjoy moderate utility costs. On average, Ohioans spend about $472 monthly on utilities, including electricity, heating, cooling, water, and garbage services. This is 11% lower than the national average of $524 per month. Bear in mind that utility costs can vary widely based on the size and type of your household.

One reason for Ohio’s relatively low utility costs is its diverse energy mix, which includes coal, natural gas, nuclear, and renewable energy sources. Additionally, Ohio’s temperate climate – while it does experience hot summers and cold winters – doesn’t usually require extreme heating or cooling compared to more extreme climates.

[best-rates utility-code=OHAEPCOL]

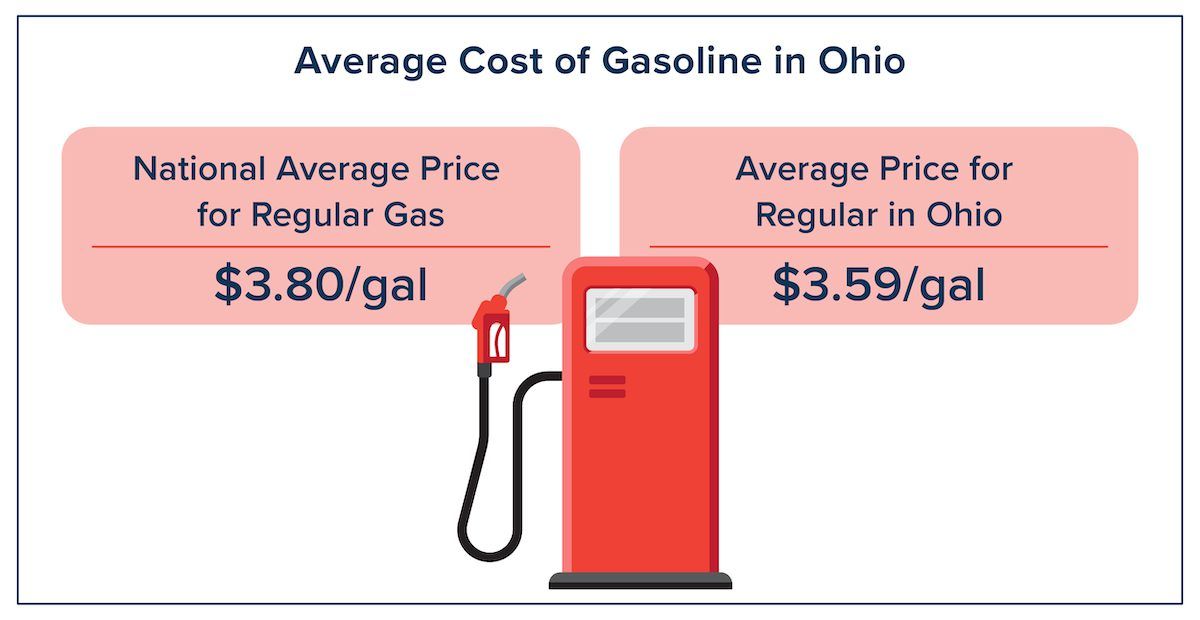

Groceries and Gasoline

When it comes to groceries, Ohio is quite affordable compared to many other states. The average monthly grocery bill for a single adult in Ohio is around $300 – $350, while a family of four can expect to spend approximately $900 per month. These costs align with or slightly below the national average, thanks to Ohio’s agricultural industry, which helps keep food prices relatively low.

Gasoline prices in Ohio are also generally lower than the national average. As of 2024, the average price per gallon of regular gasoline in Ohio is about $3.50, compared to the national average of $3.80. This difference can add up significantly, especially for commuters or those living in rural areas who rely on their vehicles for transportation.

Comparing Ohio to the Rest of the U.S.

When comparing Ohio’s cost of living to the rest of the United States, the state consistently ranks as one of the most affordable places to live. According to various cost-of-living indices, Ohio’s overall cost of living is about 8 – 12% lower than the national average. Housing is the most significant contributor to this affordability (Ohio is 22% lower when it comes to housing costs), but the state’s reasonable prices for groceries, transportation, and utilities also play a crucial role.

However, it’s important to note that costs can vary significantly within the state. Urban areas like Columbus, Cleveland, and Cincinnati tend to have higher costs of living than rural areas or smaller towns. In particular, housing and rental prices are noticeably higher in cities, though they remain lower than in many other major metropolitan areas in the U.S.

Urban vs. Rural: A Tale of Two Ohios

Staying on that theme, Ohio’s diverse geography means that living costs can vary significantly between urban and rural areas. In urban centers such as Columbus, Cleveland, and Cincinnati, the cost of living is higher, driven primarily by more expensive housing and slightly higher prices for goods and services. For example, while the average rent in Columbus is around $1,250 per month, rents in more rural areas, such as those in southeastern Ohio, can be as low as $700 per month.

On the other hand, rural areas offer much more affordable housing and lower overall living costs. However, these areas may lack some of the amenities and job opportunities found in larger cities. Additionally, residents in rural areas might face higher transportation costs if they need to commute longer distances to work or access services.

[zipcta mode=”dark” heading=”How Much Can You Save Ohio?” subheading=”Compare rates from leading providers and make the switch in only a few minutes.”]

Ohio-Specific Tips to Save Money

Living in Ohio already comes with the benefit of a lower cost of living, but there are additional ways to stretch your dollars further:

1. Take advantage of local produce

Ohio’s rich agricultural industry means fresh, locally grown produce is often available at lower prices, especially during the growing season. Shopping at farmers’ markets or joining a CSA (Community Supported Agriculture) can help reduce your grocery bill.

2. Energy efficiency programs

Ohio offers several energy efficiency programs and rebates through both government entities and utility companies. These programs can help you save on utility bills by providing incentives for upgrading to energy-efficient appliances or improving home insulation.

3. Public Transportation

Taking advantage of public transportation can significantly reduce transportation costs in urban areas. Cities like Cleveland and Columbus have extensive bus networks, and Cleveland also offers a light rail system.

4. Shop Around for Utilities

Ohio is a restructured state regarding electricity, meaning you can shop around for the best electricity rates and choose your own electricity provider. Websites like ElectricityRates.com allow you to compare providers and find the most cost-effective plan for your household.

Ohio: Where Affordability Meets Quality of Life

Ohio offers a balanced cost of living that appeals to a wide range of people, from young professionals to retirees. With affordable housing, reasonable utility costs, and lower-than-average prices for groceries and gasoline, Ohio makes it easier to maintain a comfortable lifestyle without the financial stress that comes with living in more expensive states. Whether you choose to live in a bustling city or a quiet rural town, Ohio provides options that cater to diverse needs and preferences, all while keeping your budget in check.