The browser you are using is not supported. Please consider using a modern browser.

2024 News Release: PJM Capacity Auction Prices Skyrocket

Key Takeaways

- The 2024 PJM capacity auction saw prices surge nearly ninefold, signaling significant market volatility.

- Consumers in PJM states should expect higher electricity bills as utilities pass on these increased capacity costs.

- Consumers can mitigate rising energy costs by locking in long-term electricity plans, exploring community solar, or reducing energy consumption.

Key Takeaways

- The 2024 PJM capacity auction saw prices surge nearly ninefold, signaling significant market volatility.

- Consumers in PJM states should expect higher electricity bills as utilities pass on these increased capacity costs.</li

- Consumers can mitigate rising energy costs by locking in long-term electricity plans, exploring community solar, or reducing energy consumption.

The latest PJM Interconnection capacity auction has sent ripples through the electricity markets, with prices skyrocketing to unprecedented levels. As consumers and industry stakeholders alike grapple with the implications, it’s crucial to understand what PJM is, who they serve, and why this auction matters.

What is PJM?

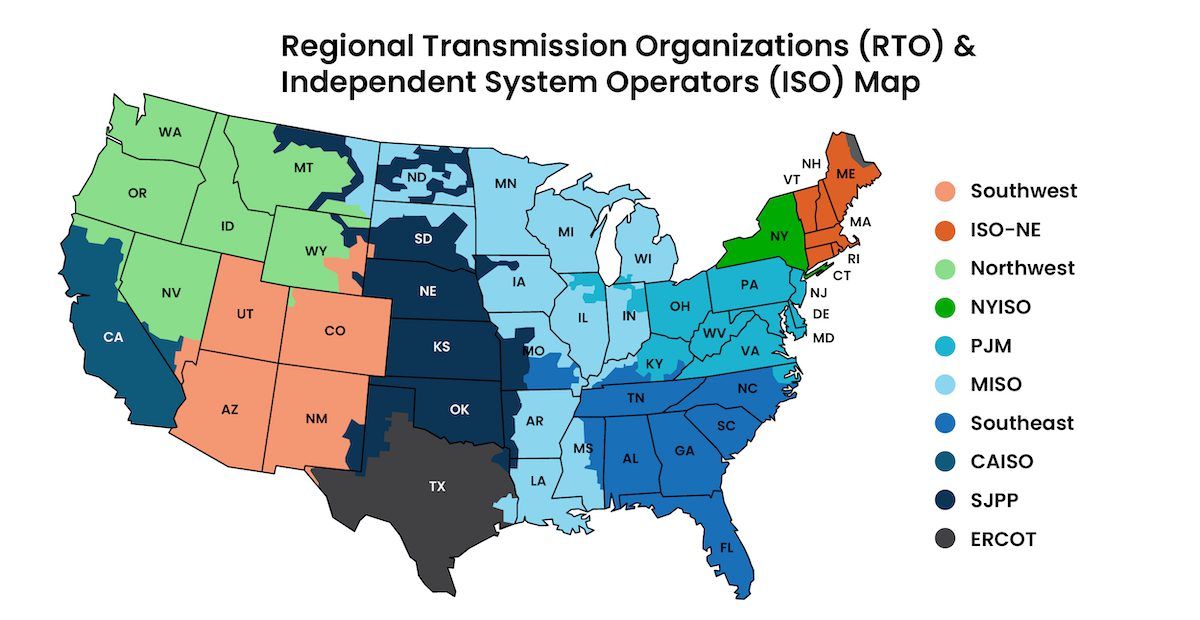

PJM Interconnection, founded in 1927, operates the largest competitive wholesale electricity market in the United States. PJM stands for Pennsylvania, New Jersey, and Maryland – the states it originally served – but today, PJM’s reach extends far beyond its initial footprint. The organization now serves over 65 million people across 13 states, covering parts of the Mid-Atlantic, like the District of Columbia, and the Midwest, like Illinois and Ohio.

PJM’s primary role is to ensure the reliable and efficient delivery of electricity to its member states. This includes managing the flow of electricity across a high-voltage transmission network, coordinating the operation of power plants, and maintaining system reliability during peak demand periods. In essence, PJM acts as a middleman between electricity generators and utilities, ensuring that power is available when and where it is needed.

The Purpose of Capacity Auctions

One of PJM’s most critical responsibilities is conducting capacity auctions. These auctions are not about buying and selling electricity as it is produced; instead, they are about securing future capacity – ensuring that there will be enough power available to meet demand several years down the road. In a capacity auction, electricity generators commit to being ready to produce a certain amount of power in the future, typically three years from the auction date. These commitments help PJM plan for future energy needs and maintain grid reliability.

The purpose of these auctions is twofold: to guarantee that there is sufficient generating capacity available to meet future electricity demand and to provide price signals that reflect the cost of maintaining that capacity. Essentially, capacity auctions hedge against future shortages, incentivizing generators to invest in maintaining or expanding their capacity.

The 2024 Auction: A Surge in Prices

The recent 2024 PJM capacity auction has sent shockwaves through the market. Prices surged nearly ninefold compared to the previous auction, signaling a significant shift in the dynamics of the energy market. This spike can be attributed to several factors, including increased demand projections, the retirement of aging power plants, and delays in bringing new renewable energy projects online.

Specifically, the auction cleared at $116.00/MW-day, a dramatic increase from the previous year’s $14.00/MW-day. This surge in capacity prices is primarily due to a combination of rising energy demand and a bottleneck in developing new generation resources, particularly renewable energy projects. Grid congestion and delays in transmission infrastructure projects have exacerbated the situation, creating a perfect storm that led to these skyrocketing prices.

The auction results indicate that PJM has secured enough capacity to meet future reliability requirements but at a much higher cost than anticipated. This outcome is a wake-up call for regulators and consumers, highlighting the growing volatility in the energy market.

Why Have PJM Prices Surged?

The sharp rise in PJM capacity prices can be traced back to a combination of market forces, grid infrastructure issues, and delays in renewable energy projects. One major contributor to the price surge is the current backlog in connecting new energy projects, particularly renewable ones, to the grid. According to industry experts, transmission bottlenecks and lengthy interconnection processes have caused significant delays in bringing new capacity online. This has resulted in a supply-demand imbalance, forcing prices to skyrocket as PJM scrambles to secure enough capacity to meet future energy needs.

Another factor behind the price surge is the retirement of aging power plants, especially fossil fuel-based ones. As older plants retire, PJM must replace that capacity, but the transition to renewable energy is not happening fast enough. The inability to bring sufficient new generation resources online – whether due to permitting challenges, supply chain issues, or the complexities of integrating renewables into the grid – has intensified pressure on the system.

Furthermore, demand for electricity has been steadily rising across PJM’s service areas. As electrification increases and extreme weather events become more frequent, the grid faces challenges in maintaining reliability. Higher demand, combined with supply constraints, has created a perfect storm, pushing prices up in the latest capacity auction. These surging prices reflect the urgent need for more streamlined grid infrastructure development, faster interconnection of renewable projects, and continued investment in maintaining reliable capacity to meet the demands of an evolving energy landscape.

What This Means for Consumers in PJM States

The implications of this auction are profound for consumers living in the states served by PJM. The sharp increase in capacity prices is likely to translate into higher electricity bills in the coming years as utilities pass these costs on to consumers. While PJM’s role is to ensure reliability, the cost of maintaining this reliability has become significantly more expensive.

The volatility in the energy market underscores the importance of making informed decisions about your electricity supply. For consumers in deregulated states within the PJM footprint, there are options to mitigate the impact of rising electricity rates:

1. Lock in a Long-Term Electricity Plan

One way to protect yourself from future price increases is to lock in a long-term electricity plan at current rates. Many electricity providers offer fixed-rate plans that can provide price stability for several years. By securing a long-term plan now, you can shield yourself from potential rate hikes driven by the recent capacity auction.

2. Explore Community Solar Options

Another option is to consider community solar programs. These programs allow you to subscribe to a share of a solar farm’s output, often at a lower cost than traditional electricity. Community solar can offer savings on your electricity bill while contributing to the growth of renewable energy in your area.

3. Monitor and Adjust Energy Usage

As electricity rates rise, being mindful of your energy consumption becomes increasingly important. Simple steps like using energy-efficient appliances, adjusting your thermostat, and reducing peak-time usage can help lower your overall energy costs.

Looking Ahead: Navigating the New Normal

The 2024 PJM capacity auction has highlighted the growing challenges facing the electricity market, particularly in terms of maintaining reliability amidst a transitioning energy landscape. As more states push for renewable energy and older power plants retire, the pressure on the grid is only expected to increase. This auction’s results are a harbinger of the volatility that could become more common in the years to come.

For consumers, the key takeaway is the importance of staying informed and proactive about your energy choices. Whether it’s locking in a fixed-rate plan, exploring community solar, or simply being more conscious of your energy usage, there are steps you can take to protect yourself from the financial impact of rising electricity rates.

One effective way to navigate this uncertain energy landscape is by using resources like ElectricityRates.com to find the most affordable energy plans in your area. Our website offers a variety of fixed-term plans that can help you secure a stable rate and avoid the fluctuations driven by market volatility. Whether you’re looking for a short-term solution or a long-term strategy, we can provide the tools you need to compare options and make the best decision for your household.

The recent PJM capacity auction serves as a reminder of the complexities and uncertainties in the electricity market. As we move forward, consumers in PJM states should brace for potential volatility and take steps now, including leveraging platforms like ElectricityRates.com, to mitigate the impact on their electricity bills.