The browser you are using is not supported. Please consider using a modern browser.

How To Save Money On Commercial And Office Building Costs

Table of Contents

If you own a business or real estate, you pay a lot each month for building operating expenses. Building overhead and operation expenses add up quickly from maintenance, insurance, rent or mortgage, and more.

Fortunately, one major cost is within your control to reduce – energy expenses. That’s right, unlike most other fixed costs, you can significantly slash your electricity bill with the right plan of attack. Understanding the typical building costs and how to save on them will help you make better financial decisions.

Without further suspense, let’s dive into the ultimate guide to cutting building expenses.

What are Commercial Building Operating Costs?

These are the costs required to maintain and operate a building. The different types of commercial property buildings are office spaces, apartments, real estate, hotels, industrial spaces, mixed-use, and retail establishments.

Commercial Building Fixed Costs Vs. Variable Costs:

Commercial building fixed costs are expenses that remain constant regardless of occupancy level or building usage. These costs include property taxes, insurance premiums, and mortgage payments.

Variable costs, on the other hand, fluctuate from month to month. They depend on factors such as energy consumption, maintenance, and repairs.

What is the Difference Between Operating Costs and Operating Expenses?

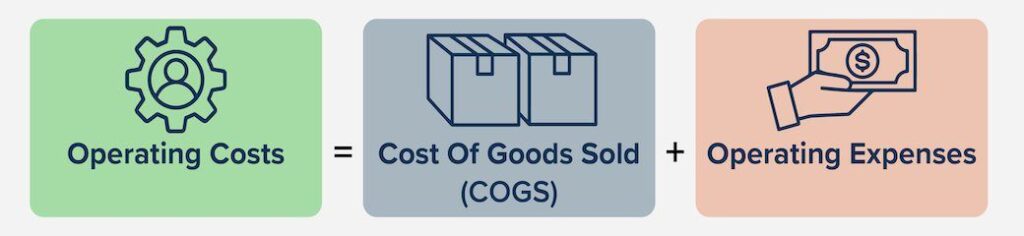

Although people sometimes mistakenly use them interchangeably, operating costs and operating expenses are different. Operating expenses make up just one part of operating costs.

Operating costs = cost of goods sold (COGS) + operating expenses.

Operating costs are the expenses incurred in running a business, including costs associated with revenue generation. Operating costs do not include expenses related to investing or financing.

What are Commercial Building Operating Expenses?

Operating expenses are any company costs that do not relate to the production of a product.

- Accounting and legal fees

- Sales and marketing

- Travel and Entertainment

- Research and development (non-capitalized)

- Office supplies and software

- Base rent or mortgage on your lease agreement

- Taxes and utilities for non-production facilities

- Commercial building maintenance costs

- Wages and benefits for non-production workers

- Insurance

What is the Cost of Goods Sold (COGS)?

The cost of goods sold are all expenses directly tied to producing goods and services.

- Materials

- Labor

- Production facility rental, utilities, insurance, and taxes

- Benefits and wages for production workers

- Equipment repair

When it comes to estimating total business operating costs, use the formula from above:

Operating costs = cost of goods sold (COGS) + operating expenses

Use your operating costs to make smarter business management choices.

What are the Average Building Operating Costs Per Square Foot?

The average cost of office buildings per square foot is the gold standard for comparing and tracking expenses. But what does it mean exactly? Operating expenses per square foot are the total cost of running a space for a year divided by the foot-by-foot area of your building. These expenses include insurance, water, maintenance, and the other costs mentioned above.

The price varies depending on multiple factors. High-end city office buildings cost more to run than small-town retail centers. Variables affecting building maintenance costs per square foot are your industry, location, building height, and construction materials used.

Ever wonder how much building maintenance costs, typical office operating costs, or the average operating expenses for apartments are? Keep reading to see how your building expenses stack up to the competition.

While it varies, here are the average office building operating costs:

- Cleaning: $1.68 per square foot (psf)

- Utility: $2.14 psf

- Fixed: $5.57 psf

- Parking: $0.58 psf

- Roads/grounds: $0.24 psf

- Repair/maintenance: $2.15 psf

- Real estate taxes: $5.32 psf

The total typical operating expenses for an office building per square foot is $17.68.

Here are the average industrial building operation costs:

- Energy: $0.06 per square foot (psf)

- Exterior building maintenance: $0.03 psf

- Grounds and landscape and exterior: $0.02 psf

- Management fees: $0.17 psf

- Water and sewer: $0.08 psf

- Real estate taxes: $0.97 psf

Total industrial commercial operating expenses are $1.54 per square foot.

How much is Commercial Electricity?

How much commercial electricity is per kWh depends on the state and type of building. Here are the average rates across the country.

For homes, the rate is 15.85 cents per kWh. Commercial businesses pay 12.52 cents per kWh. Industries pay 7.91 cents per kWh on average.

What is the Average Commercial Building Energy Consumption Per Square Foot?

Typically, the average number of kilowatt-hours per square foot for a commercial building is approximately 22.5 kWh used per year.

Here is the breakdown of approximately how much electricity a commercial building uses so you know where to focus your efforts:

- 8 kWh/square foot by refrigeration and equipment

- 7 kWh/square foot by lighting

- 3 kWh/square foot by cooling equipment

- 2 kWh/square foot by heating equipment

- 2 kWh/square foot by ventilation

- 0.5 kWh/square foot by hot water heating

How do I Reduce Building Operating Costs?

Start by learning how to check your commercial electricity bill. That will give you a baseline to aim for.

Warning: HVAC, lighting, and other energy needs account for a large portion of building expenses. Generally speaking, energy costs make up around 30% of the total operating expenses of a commercial building.

When it comes to reducing business energy expenses, there are many strategies you can implement. One of the most effective ways is to invest in energy-efficient equipment and appliances. You can significantly decrease electricity consumption by replacing outdated systems with energy-saving alternatives. Consider installing energy-efficient LED bulbs, upgrading to newer HVAC systems, or shopping for a new energy plan.

Another way to save on energy costs is by implementing smart building technologies. These technologies allow you to monitor and control energy usage in real-time, optimizing efficiency and reducing waste. Install motion sensors that automatically turn off lights in unoccupied areas or adjust the temperature settings based on occupancy patterns.

Consider installing solar panels, energy-efficient windows, or insulation for new construction or building renovations to reduce long-term energy expenses.

Educating and rewarding tenants or occupants in energy-saving practices can make a big difference. Encourage them to turn off unused lights and appliances. Provide energy-saving tips and guidelines. By creating a culture of energy conservation, you can work together to reduce energy expenses and create a more sustainable environment.

In addition to energy costs, there are other ways to reduce building expenses without sacrificing tenant comfort. For instance, you can negotiate better deals with suppliers and service providers. By comparing prices and exploring options, you can get better terms and reduce operating costs.

Look for an energy plan that meets your needs and provides the best value for your money. ElectricityRates.com offers a marketplace for finding the best energy plans based on your preferences and geographic location.

How To Calculate Operating Expense Ratio?

Operating expense ratio (OER) is a key metric that measures a company’s efficiency in utilizing operating expenses to generate revenue. You calculate it by dividing operating expenses by total revenue.

A lower OER indicates higher efficiency compared to a higher OER. The Operating Expense Ratio allows companies to compare themselves within an industry or sector.

Building Operation Cost Takeaways:

Reducing building expenses requires a comprehensive approach that addresses fixed and variable costs. To lower your building expenses, you can focus on several areas.

These include energy efficiency, smart technologies, maintenance, tenant engagement, supplier negotiations, waste reduction, and space optimization. You can achieve long-term cost savings and improve your financial bottom line with proper planning and implementation.

And remember, when you want to shop for a better commercial electricity provider, visit the ElectricityRates.com marketplace.